Investors are often confronted with a challenging tradeoff between maximizing their financial returns and supporting companies that prioritize ESG issues.

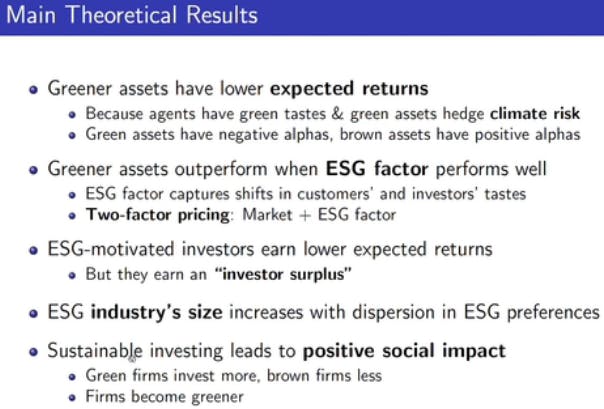

Studies have consistently shown that greener assets tend to have lower expected returns. Interestingly, ESG-motivated investors may earn lower expected returns as they tend to invest more heavily in sustainable assets. This is because these investors prioritize non-financial considerations when making investment decisions, which can lead to a portfolio that is less diversified and potentially less profitable.

Despite the potential for lower returns, sustainable investing has been shown to have a positive impact on society. By directing capital towards companies that prioritize ESG issues, investors can help drive positive change and contribute to a more sustainable future. This is a clear example of how financial decisions can have far-reaching social implications.

#investment #esginvesting #society #impactinvesting

#100daysoflearning Day 029

Originally published on My LinkedIn on March 12, 2023.